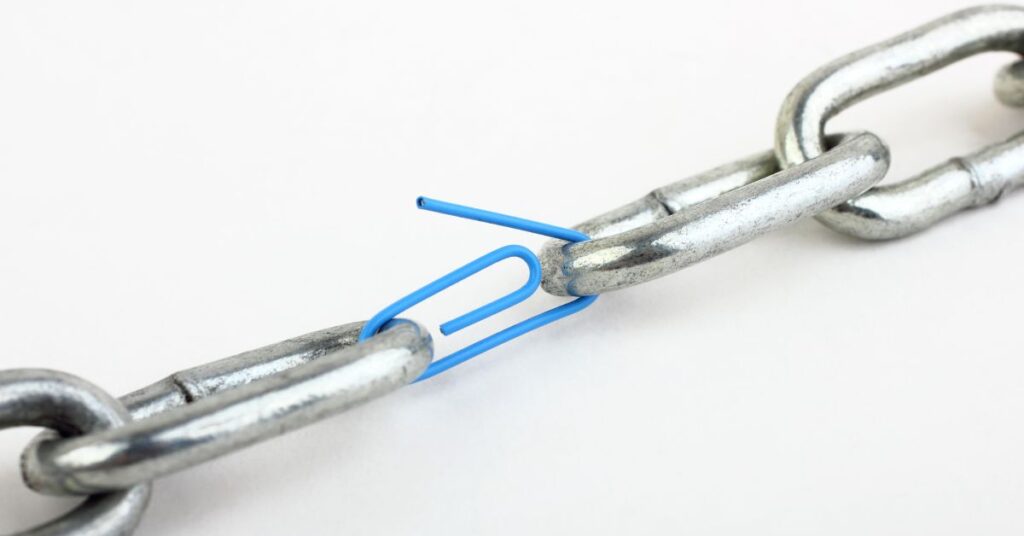

COVID-19 was a wake-up call: drugmakers learned that careful planning isn’t a nice-to-have, it’s literally lifesaving. When vaccines and treatments became urgent, fragile supply chains broke. In fact, analysts note that the pandemic “highlighted the critical need for robust and responsive pharmaceutical supply chains”. Pharma realized that poor forecasting and single sourcing can quickly turn into deadly drug shortages. In short, after COVID-19, smarter planning is now seen as a public health necessity – not just a cost-cutting tool.

How did COVID-19 expose supply chain weak spots?

The crisis exposed several blind spots. For example, much of the world’s drug ingredients come from just a few countries. When China or India shut down factories in 2020, even North American drug makers had trouble finding raw materials. Long lead times (often 4–6 months for medicines) helped in the short term, but any supply hiccup longer than a few weeks caused knock-on shortages around the globe. In Canada, these risks were magnified by limited local production and strict import rules, which already forced companies to hold extra inventory. In practice this meant many pharmacies and clinics ran low on crucial drugs when COVID struck.

At the same time, lack of real-time visibility made matters worse. Most companies were using old manual systems. Without fast data, no one could see shipments in transit or inventory levels clearly. A 2020 industry review stressed that “end-to-end visibility across production and supply is essential,” including tools to track each product from factory to pharmacy. In short, COVID showed that guessing isn’t good enough companies need up-to-the-minute data and planning tools, or they risk failing patients.

How can smarter planning protect patients?

Put simply, better planning means fewer drug shortages and faster delivery of treatments. If manufacturers can predict demand say, a flu outbreak or a new health emergency they can ramp up production ahead of time. Medoptix points out that by “improving demand forecasting,” companies can slash excess inventory and cut costs, ensuring medicines reach patients “faster and more reliably”. That matters deeply: each day without life-saving medication can mean a health crisis.

Smarter planning also gives hospitals and pharmacies breathing room. By stocking a little extra of key drugs (a “just-in-case” buffer), firms avoid panic buying and shutdowns. After COVID-19, industry surveys found many companies are adding safety stock and even dual-sourcing supplies. This approach bought time when supply chains strained. For Canada, it especially means critical medicines won’t vanish overnight when borders or factories close.

Another angle: smoother planning saves money, which in turn saves services. US regulators warned that failing to fix inefficiencies could cause “significant disruptions in drug availability and a subsequent increase in healthcare costs”. Fewer shortages means avoiding costly emergency imports or black-market pricing. These savings help keep patient care affordable, freeing resources for other needs.

What are pharma companies doing differently now?

Pharma leaders are taking concrete steps. Many have moved away from pure “just-in-time” methods. They are diversifying suppliers (adding alternate factories) and stockpiling key ingredients so they can pivot when one source dries up. Others have invested heavily in technology. Advanced analytics and AI tools are now top of mind: a recent industry report notes that COVID “significantly accelerated” adoption of data-driven, AI-powered systems to manage supply chains.

- AI-driven forecasting. Companies now use machine learning to anticipate demand. Instead of guessing next month’s needs, AI analyzes sales trends, disease outbreaks, even social media signals to spot surges. For example, experts say the industry is deploying “scenario-planning tools (often AI-powered) to simulate disruption scenarios and prepare response plans”. This means if a pandemic hits, manufacturers can quickly estimate how much of each drug is needed 30 or 60 days out and adjust production in advance.

- Supply chain visibility. Firms are building digital “control towers” to see inventory worldwide. This lets them track raw ingredients and finished products in real time. Pharmaceutical Executive magazine explains that end-to-end visibility (using tracking codes and dashboards) is now seen as critical. If a shipment is delayed in transit, planners know immediately and can reroute supplies before stockouts occur.

- Regulatory readiness. National regulators also got involved. In Canada, for instance, Health Canada now requires companies to report any risk of drug shortages well ahead of time. Companies are building compliance into their planning so they can adapt to new rules without scrambling. Medoptix’s own research notes that half of Canadian pharma CEOs face changing regulations about shortages and tracking, so automated compliance checks are a must.

- Collaboration. The pandemic showed that even competitors sometimes have to work together. Drugmakers are forming broader partnerships with each other, governments, and suppliers to share data on stocks and logistics. (One example was the Access to COVID-19 Tools Accelerator, a multi-party effort to speed up vaccine production.) Trust and coordination have become part of “smart planning.” Even logistics companies like AmerisourceBergen reported ramping up data-sharing and partnerships to keep supplies flowing.

Overall, the shift is from reactive juggling to proactive planning. Companies now routinely run “what-if” drills for shortages, just like drills for natural disasters. They’ve learned that preparation (extra suppliers, extra stock, extra data) beats scrambling for answers during a crisis.

How does Medoptix’s solution fit in?

Medoptix has built its platform, OptiPharm, exactly with these lessons in mind. OptiPharm is an AI-powered dashboard that acts like a “virtual consultant” for drug companies. It digests data past sales, pandemic trends, shipment tracking, supplier scores, and even new health regulations and then suggests smart moves.

For example, OptiPharm forecasts demand spikes so a manufacturer can ramp up production before a shortage looms. It optimizes vendor selection by analyzing which suppliers are cheapest, fastest, and most reliable. And it monitors compliance in real time, flagging any upcoming regulatory change or risk of a shortage alert. In practice, this means a company using OptiPharm can cut inventory waste (studies suggest roughly 20–30% less excess stock) and negotiate better terms with suppliers while staying audit-ready.

To put it plainly: OptiPharm helps pharma planners think ahead. Early tests suggest clients see about a 20% reduction in average inventory levels, freeing up millions in working capital. That extra efficiency means more vaccines and medicines make it through even if supply chains hiccup. In Medoptix’s words, smarter production decisions “enable improved supply chain resilience” which ultimately translates into patients getting their drugs on time, without delay or rationing.

Why should Canadians care?

Canada’s healthcare system relies heavily on timely drug deliveries. When a family doctor needs antibiotics or insulin, they can’t wait months. The lessons from COVID mean Canadian companies and regulators are finally building the safety nets needed to avoid past mistakes. Medoptix’s tools and others like it are being developed right here in Ontario to specifically address Canadian needs.

In practical terms, this means your future flu shot or heart medication is less likely to run out during a crisis. It also means our public health dollars go further when companies cut waste and avoid emergency imports, taxpayers save money. As a result, hospitals and clinics in Canada can keep shelves stocked and patients healthier.

In short, what pharma learned from COVID is that good planning saves lives. And with new AI tools and better strategies, the industry is finally putting those lessons into practice one forecast at a time.

Sources: Industry analyses and Medoptix’s business plan highlight how COVID-19 exposed pharma supply chain risks and how AI-powered planning (like Medoptix’s OptiPharm) helps companies build resilience